Sukanya Samriddhi Yojana Calculator

(सुकन्या समृद्धि योजना कैलकुलेटर)

Sukanya Samriddhi Yojana Calculator – Secure Her Future with Smart Planning

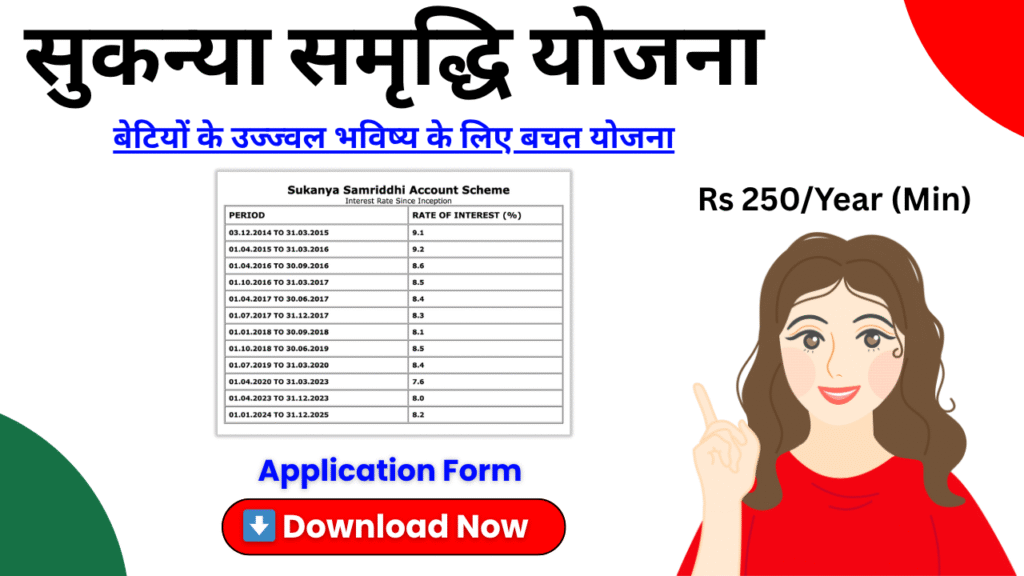

Sukanya Samriddhi Yojana (SSY) is a long-term savings scheme introduced by the Government of India in 2015 under the Beti Bachao, Beti Padhao campaign. It allows parents or legal guardians to open a dedicated savings account for their girl child at any authorized bank or post office. The scheme offers a fixed interest rate of 8.2% per annum, making it one of the most attractive and safe investment options for securing a girl’s future.

Who Can Use the SSY Calculator?

To use the SSY calculator, the following eligibility conditions must be met:

The account must be opened by the legal guardian of a girl child.

The girl child should be below 10 years of age at the time of account opening.

Required documents include:

Birth certificate of the girl child

Guardian’s identity proof, address proof, and PAN card

Once these conditions are fulfilled, the guardian can begin investing and use the calculator to estimate returns.

How Does the Sukanya Samriddhi Yojana Calculator Help?

Parents often seek reliable investment options to cover future expenses like higher education and marriage. SSY stands out due to its tax-free returns, government backing, and compounding benefits. Under Section 80C of the Income Tax Act, contributions up to ₹1.5 lakh annually are eligible for tax exemption. Additionally, the interest earned and maturity amount are also tax-free.

The SSY calculator simplifies financial planning by:

Estimating the maturity amount based on annual contributions

Showing the year of maturity

Helping adjust yearly deposits to reach a desired corpus

Allowing multiple simulations for better decision-making

Formula Used in SSY Calculator

The calculator uses the compound interest formula:

A=P(1+r/n)^nt

A = Maturity amount

P = Annual principal investment

r= Annual interest rate (e.g., 8.2%)

n = Number of times interest is compounded per year (usually yearly for SSY)

t = Number of years invested

This formula helps calculate the total amount accumulated over the investment period, including interest.

SSY Account Tenure & Contributions

The scheme matures 21 years from the date of account opening.

Contributions must be made for at least 14 years to keep the account active.

Even if no deposits are made after 14 years, the existing balance continues to earn interest until maturity.

How Can the Corpus Be Used?

Upon maturity, the girl child can withdraw the entire amount for:

Higher education (after age 18 and passing Class 10), with proof of admission and fee receipts

Marriage expenses, provided she is 18 years or older, along with an affidavit confirming her age

Premature withdrawal is allowed in cases of:

Death of the account holder

Marriage after age 18

Financial hardship, with valid supporting documents

Benefits of Using the SSY Calculator

Quick and accurate maturity projections

Helps plan long-term savings strategy

Shows year-wise breakdown of returns

Free to use and error-free output

Ideal for parents planning for education and marriage expenses

Frequently Asked Questions (FAQs)

Q1. Who is eligible to open an SSY account? Legal guardians of a girl child below 10 years of age.

Q2. How many SSY accounts can a family open? Maximum of two accounts; a third is allowed in case of twins or triplets.

Q3. What is the minimum and maximum investment? Minimum: ₹250/year | Maximum: ₹1.5 lakh/year

Q4. What happens if I skip deposits? The account remains active if at least one deposit is made each year for 14 years.

Q5. What is the maturity period? 21 years from the date of account opening.

Q6. Are SSY returns tax-free? Yes, investment, interest, and maturity amount are all tax-exempt under Section 80C.

Q7. Can I withdraw before maturity? Yes, under specific conditions like marriage, death, or financial distress.